There is more than one way to manage your money when you do a quick search online.

And, we come across this money management system that is very effective and simple, which has been personally tested by some of our team members in the past years.

It’s called the JARS money management system.

Introduced by T.Harv Eker, author of the New York Times best-selling book, “Secret of the Millionaire Mind” – where he designed specifically to help people achieve financial freedom.

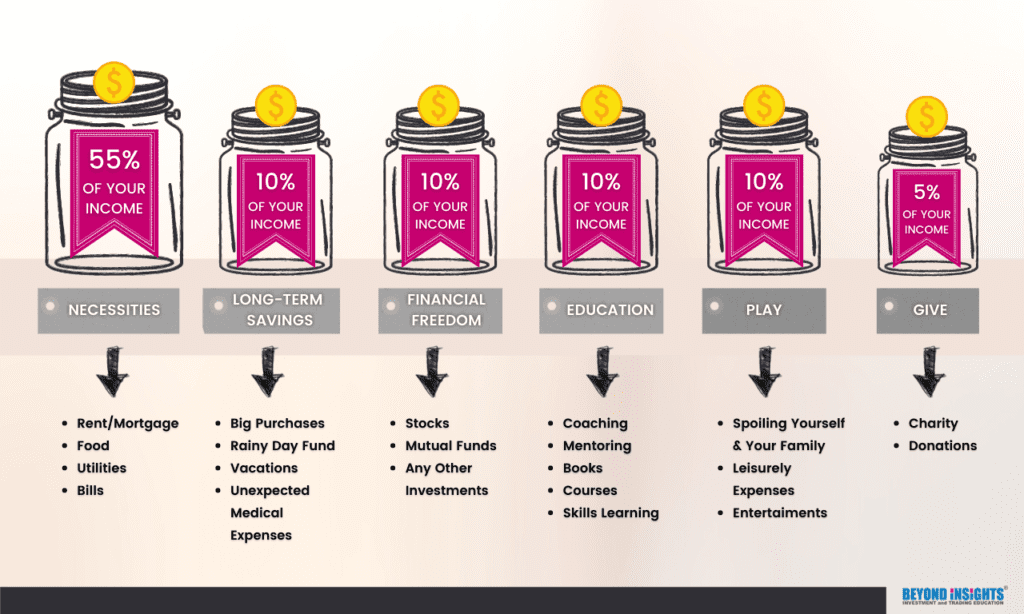

Basically, the idea of this system is that you split your income up into six (6) different accounts. You can use bank accounts or real jars – it’s up to you. 😉

So, let’s take a look at what are these Jars and what will be the percentages of your income goes into them…

(Note: The percentages given are just a guideline, you can adjust it based on your lifestyle and preference.)

To start using this system, simply set up 6 bank accounts or use actual jars, and divide your income accordingly to the JARS.

1. Necessities ( NEC )

2. Long-Term Savings (LTS)

3. Financial Freedom (FF)

4. Education (EDU)

5. Play (PLAY)

6. Give (GIVE)

Frequently Asked Questions (FAQ)

1. What if I can’t follow the percentages in the guideline?

The percentages given are recommendations – ultimate goals for you to get to…, not definitive rules. If you can’t follow the percentages to the dot, just take the amount that you can manage and start there. Remember, the habit of managing your money is far more important than the amount.

2. What do I do if I have a lot of debt to repay?

You still manage your money! Just use your LTS jar to pay down your debt. It’s important to have the habit of managing your money so that you can avoid the repeat of the debt pattern. With a habit of managing your money first and then paying down your debt while managing your money, you’ll have a higher chance of staying out of debt in the future.

3. What about credit cards?

If you can pay off your outstanding balance each month, then a credit card is a very useful tool to have. Put everything on one credit card. Then when you receive each monthly statement, go through the transactions, and mark which jar each charge should be paid from.

For example:

- Water, Electricity, Phone Bills > (NEC)

- Night out with family or friends > (PLAY)

- Books / Online Courses > (EDUCATION)

Credit cards are great to have AFTER you are in the habit of managing your money. If you’ve been a person who is constantly in credit card debt, you should NOT use a credit card.