What if we had the skills for security in the future no matter whether the current economy is good or not?

Discover the SVS Trading Framework That Enabled Me To Invest and Trade In The Stock Market In Different Market Conditions and Compound My Returns

(I'll reveal my exact gains amount in the free webinar)

This SVS Trading Framework has enabled me to gain from the stock market, regardless of the direction, whether the market is in a bull run, a bear market, a recession, or even a sideways market.

This SVS Trading Framework Helped Me Shift From A Demanding Job At A Multinational Corporation To A Full-Time Trader That Gave Me Financial Freedom, Time Freedom And Location Freedom

Here’s a genuine screenshot of my broker summary:

2020:

2021:

2022:

2023:

2024:

Using the SVS trading framework has helped me to compound my returns and navigate different market conditions. This has empowered me to be a professional trader, which gave me financial freedom, time freedom, and location freedom.

(I'll reveal my exact gains amount in the free webinar)

SVS Trading Framework

Systematic

Having a Systematic, time-tested process simplifies trading and gives you more clarity & conviction in executing your trades

Versatile

Being Versatile in the stock market allows you to trade in any market conditions, and improve your overall trading results

Safe

Being Safe in the stock market ensures your capital is protected from excessive risk and set to grow in a sustainable manner

What People Say About Using Our Framework

Racheal Tan - I had 0 knowledge in stock market and I was able to start and see gains in 3 months

Jolene - Making it a reality to be a full time trader, made 300% a year

Awards & Recognition

MIE Malaysia Influential Educators 2022

And have received these other awards of:

Top Financial Educator Winner, Global Business Outlook Winner,

The Golden Globe Tigers, and much more.

And have been featured on:

Dear Investor and Trader,

With 30 years of trading and making countless mistakes from the market, I've developed a versatile trading framework that helped me to compound my returns, that has empowered me to be a professional trader.

When I say professional, I don't mean working 8 hours a day and 5 days week. I mean being able to generate the type of returns that those specialising in stock market are generating.

For me, the returns from trading will be enough to support many years of my lifestyle and my expenses.

And, I was able to generate those returns because of my SVS Trading Framework.

Using this versatility framework, it doesn’t matter whether the market is bullish or bearish, in an uptrend or downtrend, or even sideways during consolidation.

I was able to gain from the market because I knew the method to match the market conditions.

Why Was I Able To Do This?

It all began back in 1993, when I was first exposed to and began trading in KLSE. I then began trading in the US market in 1997.

I was working at a multinational corporation, and while I was managing more than 100 staff and had a good salary.

I worked at a multinational corportation and had a good salary, but realized it was insufficient to retire

An Uncertain Future... With Insufficient Savings After Retiring

One day, I had a shocking realization... that if I live up to 80 years old and retire at 55 years old.

I would go on living for 25 years without any savings or income!

Without any investments, I realised I will not be able to provide a comfortable living condition for your family, even if I made 5 figures a month.

Does this sound at all familiar?

Today, many of would know at least one friend or friend’s parents who couldn’t retire or, more sadly... needed to depend on their children for providence.

The Preferred Asset Without Debt

After researching, I looked for different asset classes to invest in, including properties, stocks, currencies, and much more, to be financially free after I retired.

I chose the stock market as the asset class to focus on because it provided the highest probability of success.

Lost In Indicators And Blown My Account… Twice!

But when I began trading in the stock market and wasted my first 10 years on unnecessary approaches, using all sorts of methods, including using tons of indicators.

In fact, I blew my account twice, making all the mistakes a trader could make.

I blew my account twice, before finally figuring trading out

Trading Every Day For 3 Years Before Leaving My Job To Become A Full-Time Trader

But I persevered after 9 years and traded every day for 3 years until I could leave my job in June 2008.

That’s when I knew… I had the confidence, and I created a versatile framework to compound my returns.

Once I had the framework right, it was only a matter of time before I became a full-time trader.

Trading Blindly With Multiple Methods That Are Segregated Without Context

I discovered that traders are like me when I first started. And that is to trade using multiple methods without any context about the market, just depending on indicators and tactics.

Furthermore, many inexperienced traders will switch from one strategy to another and trade individual methods on their own...

Like many inexperienced traders when I started, I've used multiple indicators without much success

All they care about is using the "best indicator," the "best strategy," the "best pattern," the "best setup," and the "best stock selection process." I could go on and on.

They do not take into account intermarket correlations, market sentiments, macroeconomic factors, or industry knowledge.

That’s when I saw the truth. It was only after a long time that I discovered how to cut through the noise and get a very clear picture of consolidating and tying everything together.

The Market Always Go The Opposite of Trades

Ever hear from traders or investors that the market always goes in the opposite direction of their decisions?

When they buy stocks, the market goes down, and when they sell stocks, the market goes up!

This endless cycle has been going on for decades—and even centuries—since the New York Stock Exchange opened in the 1800s.

It’s truly frustrating that the market always goes in the opposite direction of trading decisions

It’s truly frustrating.

People who follow many trading and investing systems expect the outcome to match their prediction, but the market often goes the opposite direction... and they lose their hard-earned money in the market.

Getting Burned And Losing Hard-Earned Savings

And…the money lost usually it’s hard-earned money.

Think about it.

Some people have saved their hard-earned money and sometimes have the discipline to avoid unnecessary expenses in everyday living, like expensive food or a luxurious lifestyle...

only to lose their money in the market by making the silliest mistakes.

These mistakes include following someone else's advice, or entering the market based on news or a gut feeling without having a proper system to approach the market.

So how do we overcome this?

This is something that I reveal in my SVS Trading Framework.

A Wholistic Approach: Context Of The Market

The SVS Trading Framework is the approach I’ve been using to trade for a living as a professional trader for the past 17 years.

Having a wholistic approach will result in the highest chance of succeeding in the stock market.

The SVS Trading Framework is a wholistic approach which will result in the highest chance of succeeding in the stock market.

Leverage By Learning From My Mistakes

This wholistic formfula took me 29 years of experience in trading and hard-earned lessons, including blowing my account... twice.

One could learn these hard-earned lessons from the market itself. or leverage on my experience to avoid the disaster of the market, being susceptible to market manipulation, and getting burned by volatility.

I’ve included all my learning experience, exposure, and mistakes into my versatile trading framework to be able to trade the market whether the market is going up, going down, or moving sideways.

Wouldn’t anybody want to shortcut their learning experience by avoiding losing money and painful lessons, as well as avoid blowing their accounts (just like I did before)?

The SVS Trading Framework

And through these years of trading and investing, it gave birth to the SVS Trading Framework.

Why is it called so?

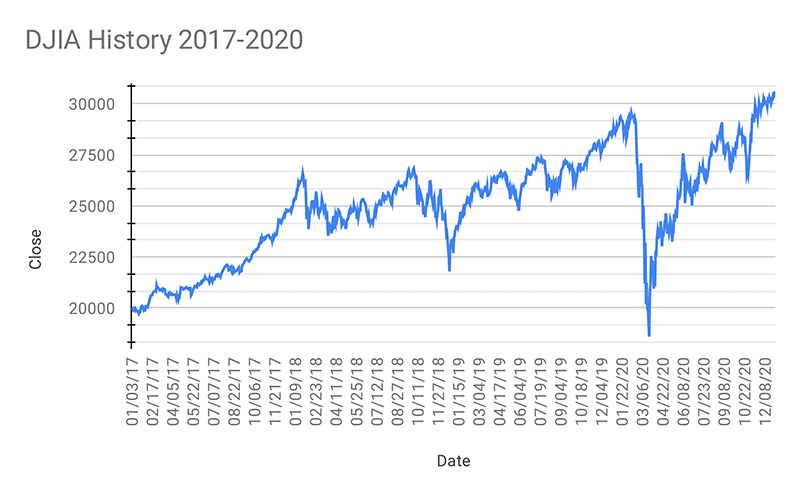

Now, that’s because I traded through many crises during the period of highest volatility in the markets.

I traded through the asian financial crisis, dotcom crisis, the subprime crisis, covid, trade wars, and recently the post-covid inflation crisis.

And, despite market corrections, recessions, and volatility during those times, I was still able to gain from trading the markets.

I traded through the asian financial crisis, dotcom crisis, the subprime crisis, covid, trade wars, and recently the post-covid inflation crisis, and was still able to gain from those markets.

Respond Accordingly When The Market Turns

Because it didn’t matter where the market was heading. I had a versatile approach and a proper response to the market in terms of the trading framework, whether it’s going up, down, or sideways…

And hence the name: the SVS Trading Framework.

It only mattered how I responded to the market.

My portfolio increased over time to a significant amount because of the versatile approach to trading and response to the market, whether it’s going up, down, or sideways

Why Am I Doing This?

In the past, I've always looked up to educators who could make a difference in people's lives, and I've always aspired to be one of them.

I could trade for a living full-time, but I decided I would do something to impact the lives of others.

And after almost 29 years (almost 3 decades) in the market, I’ve seen a lot and had countless experiences, mistakes, and learnings to be able to live by trading today.

And I believe that is my purpose: to pass on my those valuable and precious lessons of knowledge and experiences so others can have financial freedom, time freedom, and location freedom.

Stress Free Holiday With Financial, Time and Location Freedom

Aside from financial freedom, other reasons for trading include time and location freedom.

Firstly, even if I go on holidays, I would still be able to trade and control my positions and portfolio to respond to the market properly.

Secondly, going on a holiday can be stressful… if I had to come back to tend to hundreds of emails.

Trading has given me the option to go on a stress-free holiday. And with that stress-free option, I’ve been privileged to bring my parents and relatives along on a holiday to create and cherish memories together.

Trading has enabled me to go on a stress-free holiday without worrying to come back to tend to hundreds of emails and backlog of work

Anybody Can Learn This SVS Trading Framework

Through the years of trading, I realized it was not intelligence or talent that made a trader successful.

In fact, being intelligent can hurt the trader or investor.

Why is that so?

That's because intelligent people frequently overthink things!

But rather, the more important criteria is the discipline to follow a well-tested system.

In fact, we have a student, Minh, who started learning trading at 11 years old, who paper traded for 1 year, and after that traded with real money for more than 1 year and achieved a return of 50% a year.

Personal Time

In trading, one can always choose a style to suit their timing and capacity.

The good news about trading in the US stock market is that it is done outside of regular working hours.

Even the most active day trading approach will require a couple of hours outside of the regular working hours.

I do not spend long hours trading because I still believe in maintaining good health and proper rest over trading.

The question is: Is the extra time worth the future of financial, time, and location freedom?

Trading Has Provided For My Family

What would one do to provide for their family?

What would one do to secure the future?

Would 1-2 hours a day be a good investment if someone could have financial freedom?

Would anybody spend 2 hours learning about this SVS Trading Framework if this skill could give them financial, time, and location freedom?

Trading has provided for my family and given me financial, time and location freedom.

Trading has provided for my family and given me financial, time and location freedom.

It’s a skill that has the highest reward in life for me.

Wouldn’t it be great to have this skill to secure the future?

Introducing Our Free Webinar Where We Reveal The Complete SVS Trading Framework I Used To Trade For A Living

Register for our stock trading and investing webinar and discover:

We can help you to get started safely with...

A Systematic and Repeatable Process Designed for

Beginners and Experienced Trader / Investor.

This webinar is for you if..

You are NOT looking

for quick wins

Just like everything else in life, it takes effort and time to learn to be good at something. This is the same to achieve consistent results in investing and trading the stock market.

You are COMMITTED

to learning

You want to have control over your own financial success. You are eager to learn and understand how to manage your money and investments instead of depending on others do it for you.

You prefer FOLLOWING a proven systematic way

Instead of depending on random or unreliable tips, you prefer to follow a proven framework that can be repeated and allows you to start growing your wealth - just like following a step-by-step baking recipe.

Not Fly By Night

At Beyond Insights, we’ve been around for over 14 years and have trained over thousands of students.

We’re definitely not a fly-by-night company.

In fact, we make sure to invest in multiple coaches and support staff to ensure a high success probability for our students.

Anyone could reach out to us, and we’ll be glad to assist.

What Our Students Say About Our Program

Maddix Mah - Achieve average 15% return per month, by following rules

CC Ong - This is so much cheaper than what I have given back to the market

Lynda Law - Trading is not as scary as I thought...

Donald Teh - The journey from newbie to a confident trader

Fion - We want to make more money instead of just gambling away

Jason Lim - This provide me a bigger probability of success

Racheal Tan - I had 0 knowledge in stock market and I was able to start and see gains in 3 months

Jolene - Making it a reality to be a full time trader, made 300% a year

Speaker Profile

Kathlyn toh

A professional trader who earns her wealth from investing and trading in the US & global equity markets.

Kathlyn started her stock trading journey in the KLSE stock market way back in 1993 and the US Stock Market in 1997. She then pursued Options trading in Jan 2005. Since then she has traded actively in US Stocks, Options, Currency and Commodity Futures.

Her comprehensive and genuine training style has helped Beyond Insights earn the title of “Most Preferred Financial Educator” at Invest Fair for all 3 times we participated in the poll (2014- 2016). This was voted by the public who attended Invest Fair amidst stiff competition. In 2020, Beyond Insights received the "Made for The World" International Award and was announced the winner of Malaysia SME100 Awards under the fastest moving businesses of the SME sector.

Kathlyn herself was nominated Woman of the Year (for Finance & Commerce) by The Malaysian Women's Weekly magazine in 2013. Her continuous success and achievements as a female Entrepreneur has also led her to receiving the Women of Excellence Award 2021/22, under the Lifetime Achievement category.

She is very passionate about coaching people on trading psychology based on her personal journey managing her own psychology in trading.

She has been training Malaysians on how to take advantage of the stock market to grow their wealth since 2008 and continues to do so passionately.

REGISTER FOR THE FREE WEBINAR

Find out about this proven trading framework

FAQ

We organize these events for 2 reasons: to spread the message, and to recruit new students. There will be actual content shared in the session to show you how you can manage the investment on your own. Near the end of the seminar, we will briefly touch on the next steps to take if you would like to go further with us in your investment journey. This is optional and you can leave at any time.

Sure! You can help to reserve a seat for them with their personal details and email address, or simply share this page for them to register themselves. This is important because the webinar reminders will be sent out through email and WhatsApp.

We offer the most comprehensive education in financial market investment and trading you can find in Malaysia - we cover the width and depth of subjects like growth investing, fundamental & technical analysis, swing trading, trend trading, intraday trading. We also teach how to use leverage instruments safely. Most importantly we also cover trading psychology, and we are still the only one in Asia to hold a trading psychology Bootcamp.

The courses and programs we offer will give you the best chance of success because of the following distinctions:

Most experienced coaches. Our programs are facilitated by a team of full-time investors and traders who invest and trade for a living, with many years of experience in the financial market. That means you will be taught by people with real experience and actual results, who are doing it because they actually love teaching and enjoy imparting their knowledge to you.

Most complete curriculum. Because of our experience, we offer the most comprehensive education in financial market investment and trading you can find in Malaysia - we cover the width and depth of subjects like growth investing, fundamental & technical analysis, swing trading, trend trading, intraday trading. We also teach how to use leverage instruments safely. Most importantly we also cover trading psychology, and we are still the only one in Asia to hold a trading psychology Bootcamp.

Most effective support. Having trained and coached for around 5,000 students in the South East Asia region and we know what it takes for students to succeed. We understand that every individual is different and will face different challenges in their learning process - e.g. time constraint, ability to use a computer, learning capacity. That's the reason we provide coaching sessions after you complete every workshop, to make sure we are there to guide you every step of the way. But that's not it - even after you complete the workshop and coaching sessions, there are still student gatherings, revision sessions, and online learning sessions to help you keep the learning and momentum going, and to take your success to the next level.

You can contact us through any of the channels below:

Operation Hours: Monday -Friday | 10am - 6pm (excl. public holidays)

About Us

Beyond Insights was founded in 2008 on a mission to bring out the best in people and their financial future. We have a passionate & dedicated team of trainers and coaches who have coached around 5000 students in their journey to take up stock market trading and investing as a source of wealth. We have trained people from all walks of life – business owners, financial controllers, accountants, doctors, stock brokers, full-time traders, housewives, college students and even retirees or a person who is planning for retirement. All trainers and coaches are investors or traders themselves, who practice the strategies that they teach.

We are the pioneer of Investing & Trading Psychology Boot-camps in Asia and we offer a comprehensive curriculum to create financial success through stock market investing and trading. We are committed to provide the Most Complete Education with the Most Experienced Coaching Team and the Most Effective Support you can find in this region. Our commitment has been recognized in the public with accolades such as Top Financial Training Company 2013 Award by Top 10 Magazine Malaysia, Most Preferred Financial Educator 3 years in a row from 2014 to 2016 when we are participating in the Invest Fair Malaysia, "Made For The World 2020" International Award and the Malaysia SME 100 Award 2020 under the fastest moving businesses of the SME sector.